Volume 23, Issue 91 (2-2024)

refahj 2024, 23(91): 181-218 |

Back to browse issues page

Download citation:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

Abbasi A, Nasiri Aghdam A. (2024). Evaluating the Impacts of Retirement Age Reform on Financial Status of the Iranian Social Security Organization Using a Dynamic Microsimulation Model. refahj. 23(91), : 5 doi:10.32598/refahj.23.91.3940.2

URL: http://refahj.uswr.ac.ir/article-1-4190-en.html

URL: http://refahj.uswr.ac.ir/article-1-4190-en.html

Full-Text [PDF 1010 kb]

(2024 Downloads)

| Abstract (HTML) (2784 Views)

Full-Text: (1611 Views)

Introduction: More than two thirds of the Iranian population is covered by pension funds and receive various services from these funds. The livelihood of a significant part of the country's elderly population is directly dependent on the pension paid by the pension funds, and any disruption in the financial flow of the funds will immediately affect the livelihood of these people. However, the evidence indicates a deficiency in the incomes of the Social Security Organization as the largest pension fund in Iran. In this way, it is argued that countries involved with financial deficits in pension funds can improve their financial status by reforming the structure and/or parameters of retirement rules. The official retirement age is one of the most important parameters in pension reforms, which has been considered in many countries. Galasso (2006) by examining various retirement parameters shows that the retirement age is the only parameter that will be politically stable and countries should focus on it, and its impacts is assessed in this study.

Method: The research method in this study is microsimulation method. The main feature of this method is the use of individual and micro-level data and therefore, it is the most useful for questions where differences between individuals are very important. In this method, a sample of people or small units that represent the society is selected and a weight is specified for each member; so that the sum of the weights is equal to the size of the relevant population. Then, the desired policy reforms are implemented on the sample and the resulting changes are measured. Finally, by aggregating these changes with respect to the respective weights, the impact of the policy is estimated (Spadaro, 2007: 20).

Results: The results of the simulation indicate that if the current situation continues, the gap between the incomes and expenditures of the social security pension fund will deepen rapidly. The ratio of cash incomes to expenditures will reach from 82.11% in 2019 to 23.6% in 2019 and finally 14.76% in 2018. The ratio of total incomes (by including accrual incomes) to expenditures will reach from about 154% to about 47% during this 100-year period. In such a situation, the contribution rate required to equalize cash incomes and expenditures will reach from about 20% in 2019 to about 125% in 2018, and in non-cash case, from about 10% to about 94%. Other results are reported in the table below.

Table 3: Simulation results: status quo

(Source: authors’ calculations)

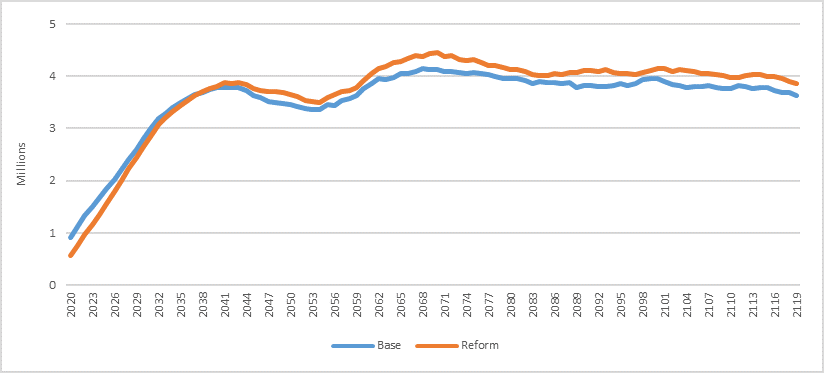

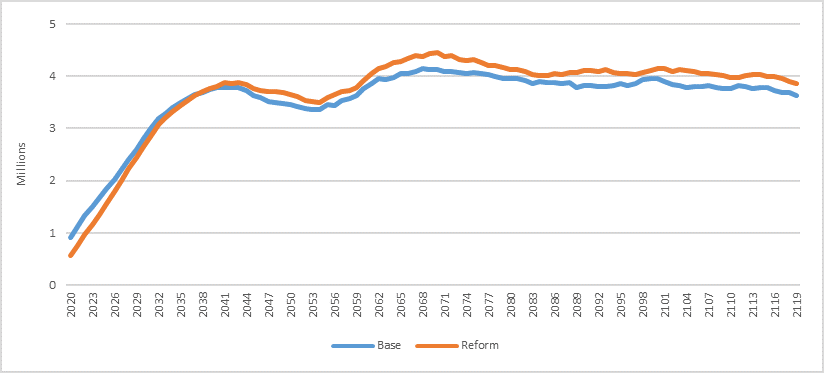

In the following, the impacts of the retirement age reform are assessed. For this purpose, it is assumed that all the age amounts required for retirement will be increased by 5 years. According to the simulation results, by this reform, the individuals eligible for retirement in 2019 will decrease from about 913 thousand to about 574 thousand people, and thus the number of new retirees will also decrease from about 150 thousand people to 56. Thus, it can be seen that the retirement age reform will have a significant effect on the number of retirees in the early years. However, people who were not able to retire due to the increase in the retirement age will find it possible after some years, and as a result, the number of people eligible for retirement in the basic scenario (unchanging of the existing parameters) and the reform scenario (5-year increase in the retirement age) will be equal at a point in time, i.e. year 2038. After this point, the number of people eligible for retirement will be more than the basic scenario, and the trend is gradually increasing. This situation is shown in the Figure 3. On the other hand, with the reduction of the possibility of retirement, the people will have to continue working, and for this reason, the number of contributors will also increase with the increase of the retirement age. (Source: authors’ calculations)

(Source: authors’ calculations)

Despite the effect of the retirement age reform on the number of retirees and contributors, the deficiency of the social security pension fund is not significantly affected. The ratio of incomes to expenditures, both in cash and in terms of government obligations, continues to decrease at a high speed. The ratio of cash income to expenditures initially stabilizes at the initial value of 82% and even increases slightly; but after 5 years and people retiring, the ratio of cash income to expenditures will also start to decrease and in 2039 it will have a very small difference from the initial amount, so that this ratio in 2029 will be approximately equal to 32% in the base scenario and 35% in the case of increasing retirement age. There are similar results regarding the equalizing contribution rate. While it is around 20% in 2019, it will be stabilized at around 20% by 2025, but after that, it starts to increase and this increasing trend continues until 2096 until it finally stabilizes around the figure of 115%; while without reforming the retirement age, this rate would be around 122%.

A summary of the results of five-year increase in retirement age is presented in the following table.

Table 3: Simulation results: retirement age reform

(Source: authors’ calculations)

Discussion: Three important factors can be mentioned in explaining why the retirement age has no significant effect on the fund imbalance. First of all, the demographic composition of the fund is such that a significant number of contributors are close to retirement age, and reforming the retirement age will only result in postponing this process for some years. Second, a significant part of contributors is included in the laws of hard and arduous jobs for which the official retirement age is not specified. Fourth, about 41% of the fund's expenditures are related to expenditures that are independent of retirement, and as a result, the change in the official retirement age has no effect on them. Finally, the low population growth will reduce labor market entry in the coming years, which is also reflected in the overall decrease in the number of contributors. In this way, it is recommended that policymakers, along with planning to increase the official retirement age, consider other solutions such as reforming the rules of retirement in hard and arduous jobs and increasing the number of contributors by encouraging voluntary contributing, reducing contribution evasion and increasing the working population.

Ethical Considerations

Authors’ contributions

All authors contributed in producing of the research.

Funding

The present study is financially sponsored by Social Security Organization Research Institute.

Conflicts of interest

The authors declared no conflict of interest.

Acknowledgments

In this article, all rights relating to references are cited, and resources are carefully

listed.

Method: The research method in this study is microsimulation method. The main feature of this method is the use of individual and micro-level data and therefore, it is the most useful for questions where differences between individuals are very important. In this method, a sample of people or small units that represent the society is selected and a weight is specified for each member; so that the sum of the weights is equal to the size of the relevant population. Then, the desired policy reforms are implemented on the sample and the resulting changes are measured. Finally, by aggregating these changes with respect to the respective weights, the impact of the policy is estimated (Spadaro, 2007: 20).

Results: The results of the simulation indicate that if the current situation continues, the gap between the incomes and expenditures of the social security pension fund will deepen rapidly. The ratio of cash incomes to expenditures will reach from 82.11% in 2019 to 23.6% in 2019 and finally 14.76% in 2018. The ratio of total incomes (by including accrual incomes) to expenditures will reach from about 154% to about 47% during this 100-year period. In such a situation, the contribution rate required to equalize cash incomes and expenditures will reach from about 20% in 2019 to about 125% in 2018, and in non-cash case, from about 10% to about 94%. Other results are reported in the table below.

Table 3: Simulation results: status quo

| 2119 | 2081 | 2051 | 2020 | |

| 56.8 | 56.8 | 57.5 | 56.5 | average retirement age |

| 14.8% | 16.0% | 22.5% | 82.1% | ratio of cash income to expenditure |

| 47.0% | 45.1% | 53.2% | 153.9% | ratio of total income to expenditure |

| 125.4% | 115.4% | 81.4% | 19.9% | equalizing contribution rate (cash) |

| 93.9% | 90.0% | 63.3% | 9.9% | equalizing contribution rate (total) |

| 22,517 | 21,532 | 14,404 | 3,147 | Pensioners (×1000) |

| 16,694 | 17,571 | 17,554 | 13,382 | contributors (×1000) |

| 3,633 | 3,962 | 3,413 | 913 | individuals eligible for retirement (×1000) |

| 538 | 650 | 530 | 150 | new retirees (×1000) |

| 614 | 659 | 648 | 448 | new contributors (×1000) |

| 80.9% | 84.1% | 81.5% | 68.1% | replacement rate |

| 0.281 | 0.282 | 0.294 | 0.345 | pensioners Gini coefficient |

In the following, the impacts of the retirement age reform are assessed. For this purpose, it is assumed that all the age amounts required for retirement will be increased by 5 years. According to the simulation results, by this reform, the individuals eligible for retirement in 2019 will decrease from about 913 thousand to about 574 thousand people, and thus the number of new retirees will also decrease from about 150 thousand people to 56. Thus, it can be seen that the retirement age reform will have a significant effect on the number of retirees in the early years. However, people who were not able to retire due to the increase in the retirement age will find it possible after some years, and as a result, the number of people eligible for retirement in the basic scenario (unchanging of the existing parameters) and the reform scenario (5-year increase in the retirement age) will be equal at a point in time, i.e. year 2038. After this point, the number of people eligible for retirement will be more than the basic scenario, and the trend is gradually increasing. This situation is shown in the Figure 3. On the other hand, with the reduction of the possibility of retirement, the people will have to continue working, and for this reason, the number of contributors will also increase with the increase of the retirement age.

Figure 3: The impact of retirement age reform on the number of individuals eligible for retirement

Despite the effect of the retirement age reform on the number of retirees and contributors, the deficiency of the social security pension fund is not significantly affected. The ratio of incomes to expenditures, both in cash and in terms of government obligations, continues to decrease at a high speed. The ratio of cash income to expenditures initially stabilizes at the initial value of 82% and even increases slightly; but after 5 years and people retiring, the ratio of cash income to expenditures will also start to decrease and in 2039 it will have a very small difference from the initial amount, so that this ratio in 2029 will be approximately equal to 32% in the base scenario and 35% in the case of increasing retirement age. There are similar results regarding the equalizing contribution rate. While it is around 20% in 2019, it will be stabilized at around 20% by 2025, but after that, it starts to increase and this increasing trend continues until 2096 until it finally stabilizes around the figure of 115%; while without reforming the retirement age, this rate would be around 122%.

A summary of the results of five-year increase in retirement age is presented in the following table.

Table 3: Simulation results: retirement age reform

| 2119 | 2081 | 2051 | 2020 | |

| 56.5 | 58.8 | 58.4 | 58.3 | average retirement age |

| 81.9% | 24.5% | 16.8% | 15.6% | ratio of cash income to expenditure |

| 153.8% | 57.2% | 47.1% | 49.6% | ratio of total income to expenditure |

| 20.0% | 74.4% | 109.7% | 118.4% | equalizing contribution rate (cash) |

| 10.0% | 56.8% | 84.5% | 87.0% | equalizing contribution rate (total) |

| 3,147 | 13,323 | 20,525 | 21,435 | Pensioners (×1000) |

| 13,382 | 18,564 | 18,651 | 17,738 | contributors (×1000) |

| 574 | 3,613 | 4,133 | 3,863 | individuals eligible for retirement (×1000) |

| 56 | 569 | 631 | 598 | new retirees (×1000) |

| 448 | 648 | 659 | 614 | new contributors (×1000) |

| 88.1% | 92.3% | 91.7% | 91.5% | replacement rate |

| 0.345 | 0.271 | 0.266 | 0.264 | pensioners Gini coefficient |

Discussion: Three important factors can be mentioned in explaining why the retirement age has no significant effect on the fund imbalance. First of all, the demographic composition of the fund is such that a significant number of contributors are close to retirement age, and reforming the retirement age will only result in postponing this process for some years. Second, a significant part of contributors is included in the laws of hard and arduous jobs for which the official retirement age is not specified. Fourth, about 41% of the fund's expenditures are related to expenditures that are independent of retirement, and as a result, the change in the official retirement age has no effect on them. Finally, the low population growth will reduce labor market entry in the coming years, which is also reflected in the overall decrease in the number of contributors. In this way, it is recommended that policymakers, along with planning to increase the official retirement age, consider other solutions such as reforming the rules of retirement in hard and arduous jobs and increasing the number of contributors by encouraging voluntary contributing, reducing contribution evasion and increasing the working population.

Ethical Considerations

Authors’ contributions

All authors contributed in producing of the research.

Funding

The present study is financially sponsored by Social Security Organization Research Institute.

Conflicts of interest

The authors declared no conflict of interest.

Acknowledgments

In this article, all rights relating to references are cited, and resources are carefully

listed.

Type of Study: orginal |

Received: 2023/03/25 | Accepted: 2023/09/27 | Published: 2024/02/14

Received: 2023/03/25 | Accepted: 2023/09/27 | Published: 2024/02/14

Send email to the article author

| Rights and permissions | |

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. |