Volume 23, Issue 91 (2-2024)

refahj 2024, 23(91): 145-179 |

Back to browse issues page

Download citation:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

samani H, Zarea M H, khabazi khaneghah M. (2024). The Impact of Pension Funds Expenditures on Poverty and Inequality. refahj. 23(91), : 4 doi:10.32598/refahj.23.91.2801.2

URL: http://refahj.uswr.ac.ir/article-1-4126-en.html

URL: http://refahj.uswr.ac.ir/article-1-4126-en.html

Full-Text [PDF 607 kb]

(1109 Downloads)

| Abstract (HTML) (2229 Views)

Full-Text: (1034 Views)

Intorduction: One of the main objectives of social security programs (especially social insurance) is to alleviate poverty and inequality. Retirement insurance is one of the major subjects of social security, managed by pension funds. The activities of pension funds can affect a large population. Due to the increasing number of retirees in recent years, the expenses of pension funds have increased accordingly. Hence, it is essential to evaluate the relationship between pension fund expenses and poverty and inequality. The relevant literature suggests that the effect of social security expenses on poverty and inequality was found to be significant and supportive for insurance aspects. However, the effect of pension expenses of pension funds on poverty and inequality has not been investigated so far.

Method: This study uses panel data, and the data were derived from statistical yearbooks. Poverty and inequality data were collected from calculated research data in a study called "examining the poverty and inequality in Iran between 2001 and 2019", reported by Social Security Research Institute. The study adopts econometric methods to evaluate the research hypotheses using the panel data and Stata software. First, the data type and whether the effects are random or constant were determined using statistical hypothesis tests (e.g., F-test, Hausman test, and Lagrange coefficient). Then, the classic hypotheses were assessed, and the generalized least square (GLS) method was used in the case of heteroscedasticity and autocorrelation. (soori, 2017).

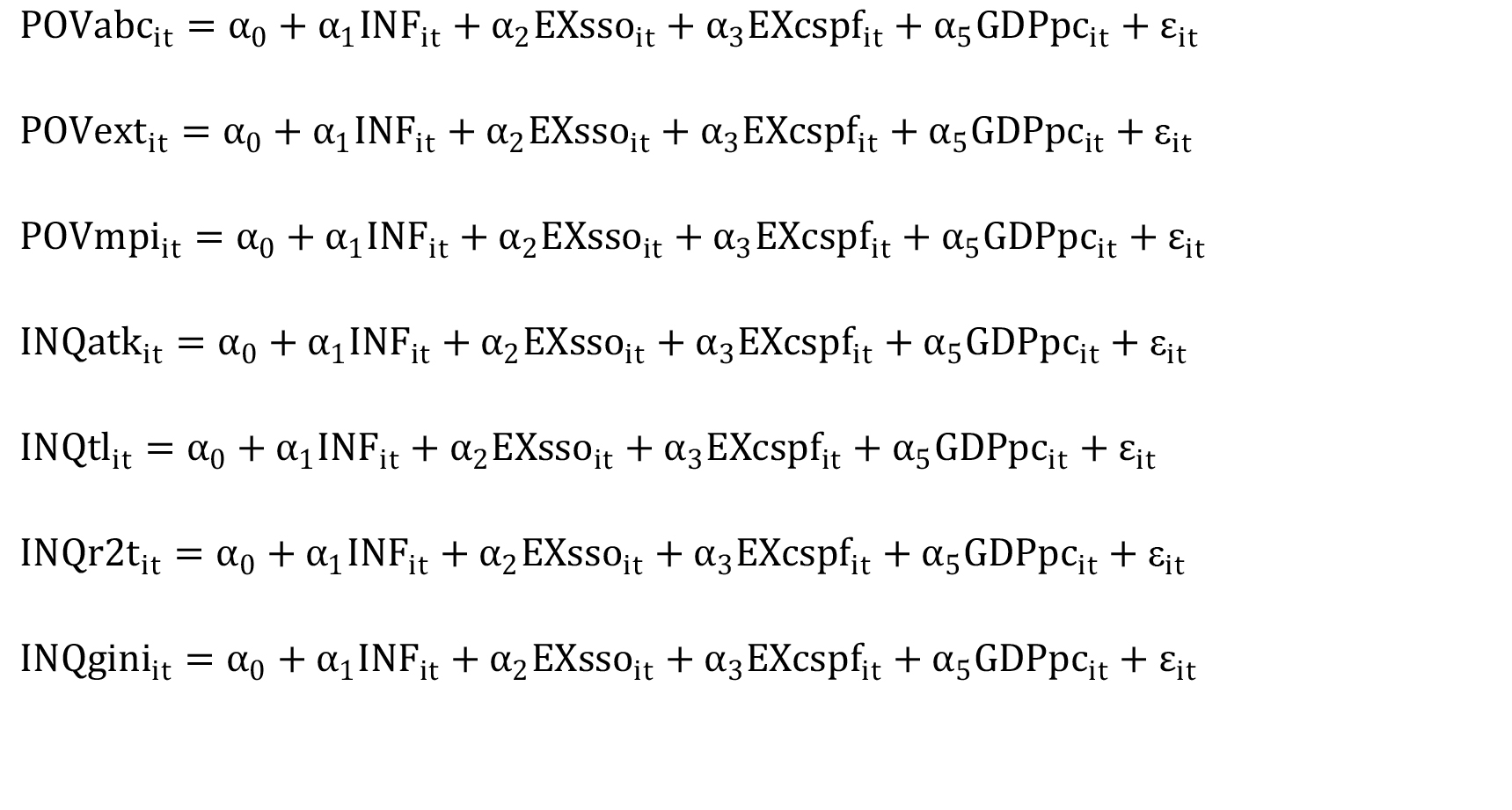

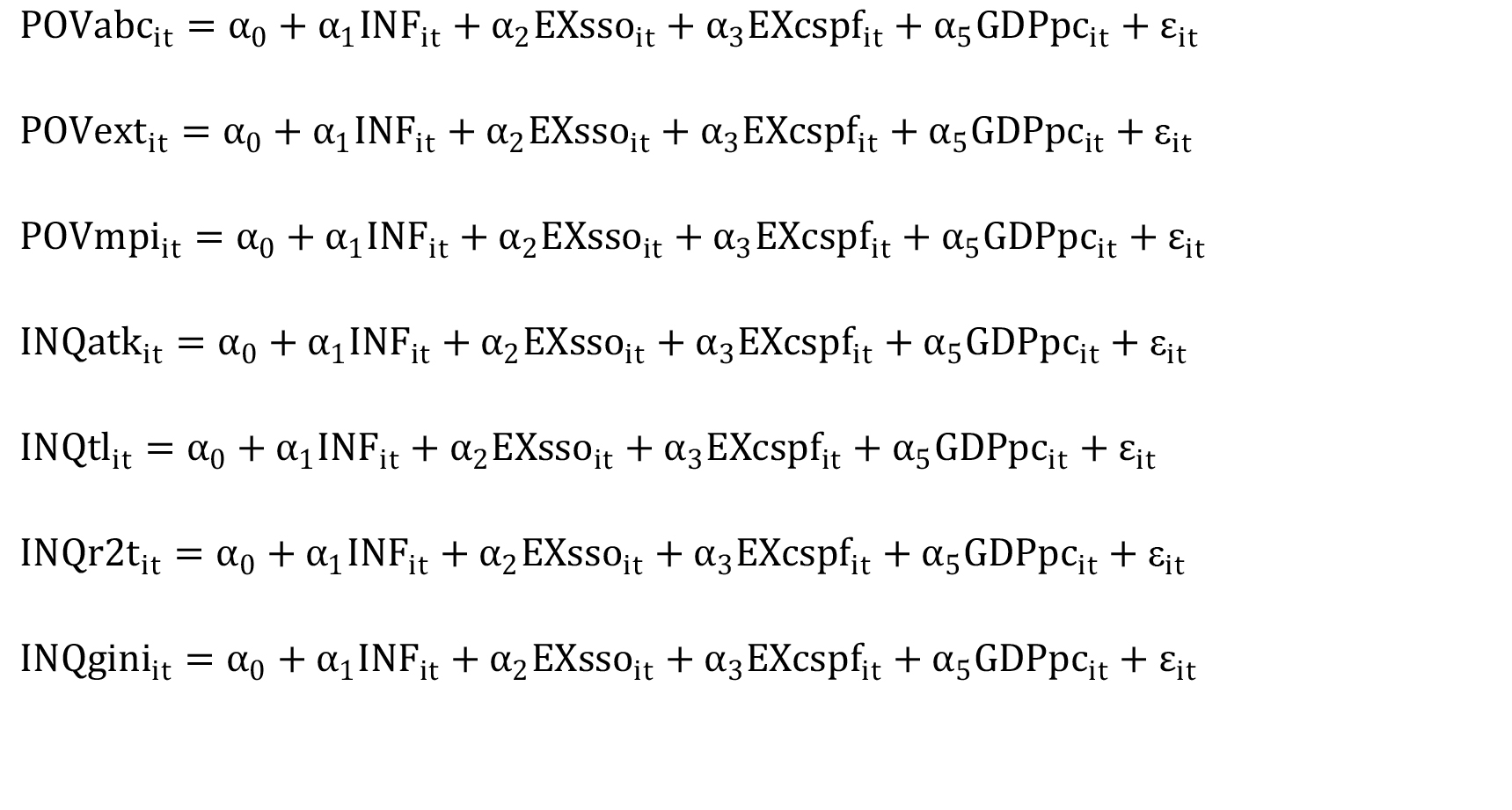

The investigated models are 7 cases:

Inequality (INQ): In this study, Gini (INQgini), Theil index (INQtl), Atkinson (INQatk), and the ratio of the top two income deciles to the bottom two income deciles (INQr2t) were used for the inequality of. The data source of inequality in this research is the data calculated in a study titled "Investigation of the situation of poverty and inequality in Iran 1380-1398" published by the Social Security Research Institute.

Poverty (POV): The poverty indicators used in this study include: the percentage of poor people based on absolute poverty line (POVabc), extreme poverty line (POVext) and Multidimensional Poverty Index (POVmpi). The poverty data is also used from the data calculated in the study "Poverty and inequality situation in Iran in the period of 1380-1398".

EXsso: The share of Social Security Organization's pensions expense from the GDP.

EXcspf: The share of Civil Servants Pension Organization's pensions expense from the GDP.

GDPpc: GDP per capita.

Findings: The final results were obtained using the generalized least squares method.

Table 1: Final results

Source: study findings

The results indicate a negative and significant impact of Social Security Organization's pensions expense on poverty and inequality in all the examined indicators, also the results show that the impact of Civil Servants Pension Fund's pensions expense on poverty and inequality is positive and significant.

The impact of other explanatory variables is as follows: the impact of inflation on absolute poverty and extreme poverty is positive and significant; but the impact of inflation on multidimensional poverty is not significant, and the impact of inflation on inequality indices (Atkinson, Thiel, the ratio of the top two deciles of income to the two bottom deciles of income and Gini) is positive and significant.

The impact of GDPpc on poverty is negative and significant in multidimensional poverty indicators. Also, the impact of GDPpc on inequality is positive and significant in Atkinson, Thiel, the ratio of the top two deciles of income to the bottom two deciles of income and Gini.

Discussin: The main purpose of this study is to investigate the impact of Social security organizations pensions expense and Civil Servants Pension Fund pensions expense on poverty and inequality. As seen, the impact of pension expenditures of both funds on poverty and inequality is significant, but Civil Servants Pension Fund’s pensions expense, unlike Social security organizations pensions expense, had a positive impact on poverty and inequality. These different results can be justified by the fact that due to the severe financial deficit of Civil Servants Pension Fund, a large part of Civil Servants Pension Fund’s pensions expense is financed through the government budget. The government allocates a large part of the welfare and social assistance budget to pay Cicil Servants Pension Fund’s pensions expense and other pension funds under the government that have a deficit; therefore, the share of other social security items, which includes assistance for the poor, decreases. Also, the members of this fund are government employees who receive a higher pension on average; therefore, increasing Civil Servants Pension Fund's pensions expense, a large part of which is paid from the government's welfare budget, cannot be effective in reducing poverty and inequality.

Ethical considerations

Author Contributions

All authors contributed to this article.

Funding

Financial support was received from the Social Security Research institute for the preparation of this article.

Conflict of interest

There is no conflict of interest in this article.

Observance of the ethical principles of research

In this study, all matters related to research ethics have been observed

Method: This study uses panel data, and the data were derived from statistical yearbooks. Poverty and inequality data were collected from calculated research data in a study called "examining the poverty and inequality in Iran between 2001 and 2019", reported by Social Security Research Institute. The study adopts econometric methods to evaluate the research hypotheses using the panel data and Stata software. First, the data type and whether the effects are random or constant were determined using statistical hypothesis tests (e.g., F-test, Hausman test, and Lagrange coefficient). Then, the classic hypotheses were assessed, and the generalized least square (GLS) method was used in the case of heteroscedasticity and autocorrelation. (soori, 2017).

The investigated models are 7 cases:

Inequality (INQ): In this study, Gini (INQgini), Theil index (INQtl), Atkinson (INQatk), and the ratio of the top two income deciles to the bottom two income deciles (INQr2t) were used for the inequality of. The data source of inequality in this research is the data calculated in a study titled "Investigation of the situation of poverty and inequality in Iran 1380-1398" published by the Social Security Research Institute.

Poverty (POV): The poverty indicators used in this study include: the percentage of poor people based on absolute poverty line (POVabc), extreme poverty line (POVext) and Multidimensional Poverty Index (POVmpi). The poverty data is also used from the data calculated in the study "Poverty and inequality situation in Iran in the period of 1380-1398".

EXsso: The share of Social Security Organization's pensions expense from the GDP.

EXcspf: The share of Civil Servants Pension Organization's pensions expense from the GDP.

GDPpc: GDP per capita.

Findings: The final results were obtained using the generalized least squares method.

Table 1: Final results

| INQgini | INQr2t | INQtl | INQatk | POVabc | POVmpi | POVext |

| 0.353 (0.058) |

0.131 (0.023) |

0.331 (0.205) |

0.240 (0.050) |

3.762 (0.000) |

0.055 (0.871) |

2.878 (0.000) |

INF |

| -0.473 (0.167) |

-0.419 (0.000) |

-1.704 (0.000) |

-0.256 (0.168) |

-3.811 (0.000) |

-5.080 (0.000) |

-3.170 (0.000) |

EXsso |

| 1.504 (0.000) |

0.547 (0.000) |

2.773 (0.000) |

0.798 (0.000) |

1.980 (0.010) |

0.932 (0.217) |

2.977 (0.002) |

EXcspf |

| 0.748 (0.005) |

0.594 (0.000) |

1.055 (0.000) |

-0.379 (0.011) |

-0.790 (0.166) |

-2.289 (0.001) |

-0.836 (0.262) |

GDPpc |

| 32.551 (0.000) |

5.574 (0.000) |

20.701 (0.000) |

8.749 (0.000) |

20.333 (0.000) |

28.186 (0.000) |

9.177 (0.000) |

C |

| 0.17 | 0.24 | 0.12 | 0.17 | 0.64 | 0.15 | 0.43 | R2 |

The results indicate a negative and significant impact of Social Security Organization's pensions expense on poverty and inequality in all the examined indicators, also the results show that the impact of Civil Servants Pension Fund's pensions expense on poverty and inequality is positive and significant.

The impact of other explanatory variables is as follows: the impact of inflation on absolute poverty and extreme poverty is positive and significant; but the impact of inflation on multidimensional poverty is not significant, and the impact of inflation on inequality indices (Atkinson, Thiel, the ratio of the top two deciles of income to the two bottom deciles of income and Gini) is positive and significant.

The impact of GDPpc on poverty is negative and significant in multidimensional poverty indicators. Also, the impact of GDPpc on inequality is positive and significant in Atkinson, Thiel, the ratio of the top two deciles of income to the bottom two deciles of income and Gini.

Discussin: The main purpose of this study is to investigate the impact of Social security organizations pensions expense and Civil Servants Pension Fund pensions expense on poverty and inequality. As seen, the impact of pension expenditures of both funds on poverty and inequality is significant, but Civil Servants Pension Fund’s pensions expense, unlike Social security organizations pensions expense, had a positive impact on poverty and inequality. These different results can be justified by the fact that due to the severe financial deficit of Civil Servants Pension Fund, a large part of Civil Servants Pension Fund’s pensions expense is financed through the government budget. The government allocates a large part of the welfare and social assistance budget to pay Cicil Servants Pension Fund’s pensions expense and other pension funds under the government that have a deficit; therefore, the share of other social security items, which includes assistance for the poor, decreases. Also, the members of this fund are government employees who receive a higher pension on average; therefore, increasing Civil Servants Pension Fund's pensions expense, a large part of which is paid from the government's welfare budget, cannot be effective in reducing poverty and inequality.

Ethical considerations

Author Contributions

All authors contributed to this article.

Funding

Financial support was received from the Social Security Research institute for the preparation of this article.

Conflict of interest

There is no conflict of interest in this article.

Observance of the ethical principles of research

In this study, all matters related to research ethics have been observed

Type of Study: orginal |

Received: 2022/09/20 | Accepted: 2023/09/27 | Published: 2024/02/14

Received: 2022/09/20 | Accepted: 2023/09/27 | Published: 2024/02/14

Send email to the article author

| Rights and permissions | |

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. |