Volume 25, Issue 97 (7-2025)

refahj 2025, 25(97): 199-225 |

Back to browse issues page

Download citation:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

Mohammadi nesheli Y, saadat R, kashiyan A. (2025). Unequal Exchange Rate Pass-Through across urban and rural income groups in Iran. refahj. 25(97), : 7 doi:10.32598/refahj.25.97.4507.1

URL: http://refahj.uswr.ac.ir/article-1-4317-en.html

URL: http://refahj.uswr.ac.ir/article-1-4317-en.html

Keywords: exchange rate transition, price of goods and services, income groups, structural VAR model

Full-Text [PDF 595 kb]

(623 Downloads)

| Abstract (HTML) (1907 Views)

Full-Text: (339 Views)

Extended Abstract

Introduction

In international economics, countries interact primarily through trade in goods/services and capital flows, making the exchange rate a critical element of economic relations. A deviation of the exchange rate from its equilibrium can destabilize economic performance. The exchange rate significantly influences macroeconomic variables—especially in today’s globalized economy where countries are highly interdependent. It serves as a key indicator of a country’s foreign trade position, affecting variables such as prices, production, and employment. With expanded global markets, domestic prices are increasingly affected by international exchange rate fluctuations. Open economies are now more exposed to external shocks, which often appear as exchange rate changes. The process through which these changes impact domestic price levels known as exchange rate pass-through is complex. Its extent is not only a channel for transmitting shocks but is also shaped by various micro and macroeconomic factors. At the micro level, elements such as the price elasticity of demand and the market power of firms play a role. At the macro level, factors like inflation, the output gap, exchange rate volatility, and the degree of economic openness are influential. These determinants can change with each shock, affecting the intensity and nature of pass-through. Consequently, the exchange rate’s impact—both on prices and quantities—is crucial for consumers in the short and long term, ultimately influencing their overall welfare.

Method

This study was conducted based on theoretical foundations and existing literature, as well as using econometric modeling. The econometric model used in this study is structural VAR (SVAR). In VAR models, the values of a variable are fitted to the values with its own interval.

In the current research, the time series data of 1363-1401(1984–2022) have been used annually, all the statistics and information of the time series and cross-sectional variables of the income groups used in the research (price of consumer goods, nominal exchange rate and amount of income) from the center Statistics of Iran The central bank has been collected, the general research model is as follows:

Z= [lnEX,lnY,LNP]

LnEX: is the log of the nominal exchange rate.

LnY: log of average income in income deciles

LNP log of the average price of consumer goods

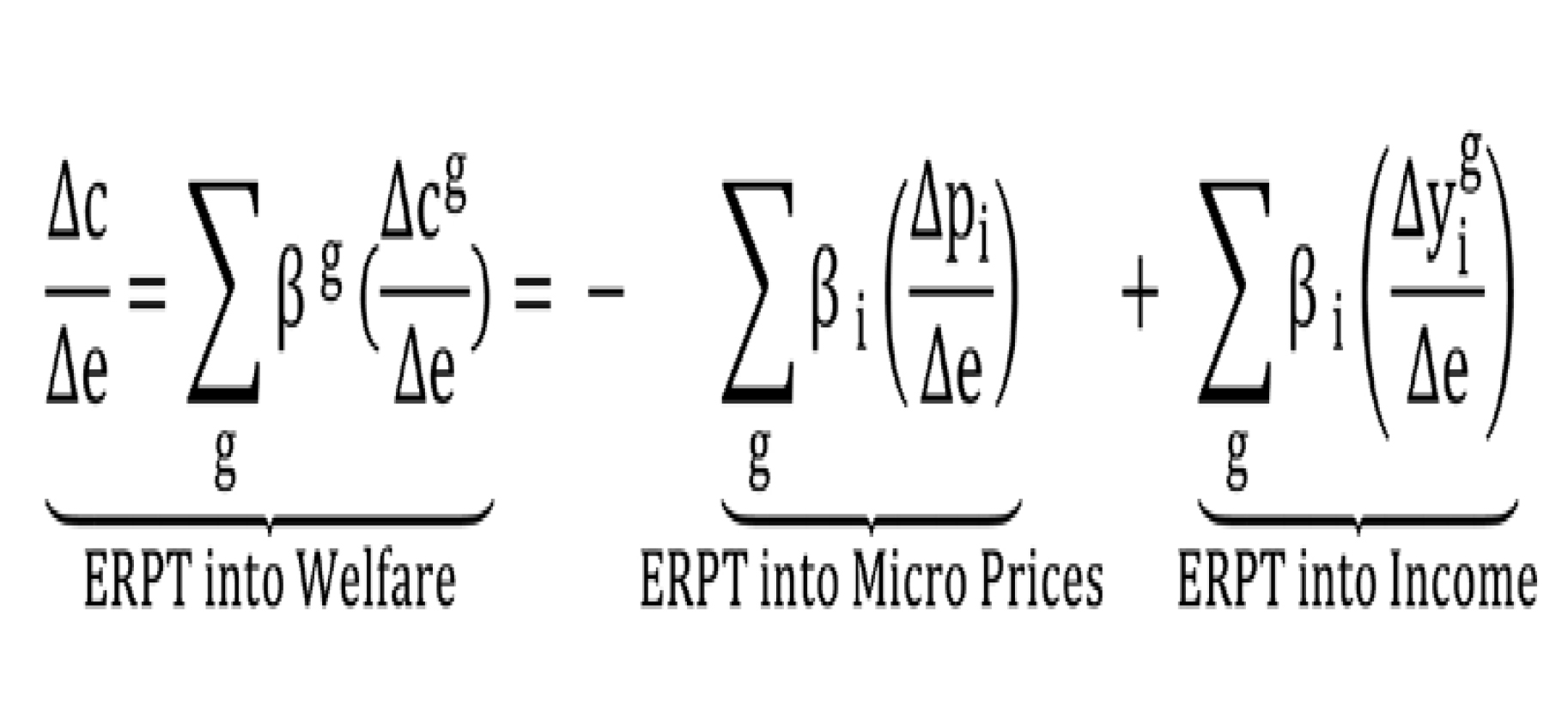

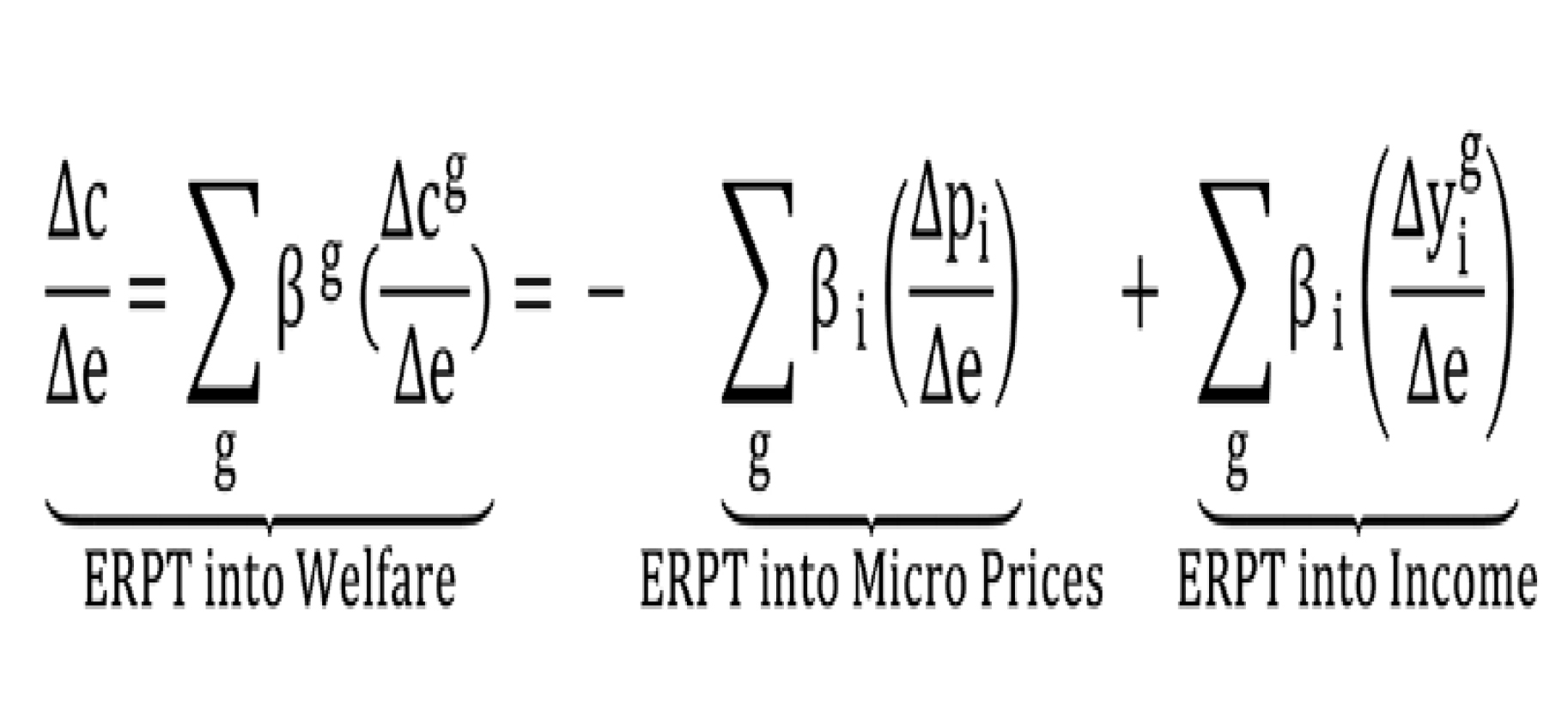

In each income decile, before estimating the considered model, the series have been tested for reliability. Due to the annuality of the data used, all the data have been tested with a time interval. The effects of Exchange Rate Pass-Through on welfare have been analyzed through the analysis of a generalized equation as follows.

In this equation, the effect of Exchange Rate Pass-Through on price, income and finally on well-being has been evaluated.

Findings

The estimation of the exchange rate on the expenses of each income decile was examined separately. The results are shown in two urban and rural areas. These results are shown through the decrease in the average income in income deciles and the effect in increasing the average price level in urban and rural areas as a percentage. The greatest impact of the exchange rate Pass-Through was observed on the costs related to three health groups, education and communication costs. So that in almost all urban and rural income groups, this effect was about 0.7% and the highest level. Meanwhile, the higher urban income deciles have faced a higher effectiveness percentage in the health and education expenditure group.

The results of a 1% exchange rate shock (devaluation of the national currency, rial, against the dollar) lead to an approximate 0.72% reduction in welfare, with a range between 0.65% and 0.79% for income deciles in urban areas. This finding confirms the results of other studies on incomplete exchange rate pass-through, such as Mehrabi (2010) and Issazadeh Roshan (2014). For rural income deciles, this impact ranges between 0.71% and 0.75%. It is clearly observed that lower-income deciles in rural areas are significantly more exposed to exchange rate pass-through compared to urban areas. In the long term, the ninth and tenth income deciles in urban areas experience the greatest impact from exchange rate pass-through. These results are largely consistent with the findings of Yilmazkuday (2020) in Turkey, although the intensity of the exchange rate shock effect for higher-income deciles in Turkey is reported at about 0.81%, which shows a difference of approximately 0.02% to 0.09% .Regarding the type of expenditure, three categories of costs are more affected than others: communication expenses, education expenses, and health expenses, with this pattern being evident in both urban and rural areas. This highlights the need to pay particular attention to these three expenditure categories, especially for lower-income deciles.

Discussion

Exchange rate shocks significantly alter the cost and availability of basic consumer goods, prompting consumers and producers to adjust their consumption and production behaviors. To protect household welfare and mitigate the impact of currency fluctuations, it’s essential to examine how these changes affect various urban and rural income groups. Studies show that a 1% increase in the exchange rate leads to an incomplete pass-through effect on prices, as noted by heydari and rashidi (2018) and Asgharpour and Mahdilou (2014). However, import-dependent goods and services, such as medicine and healthcare, experience a more substantial impact, according to Yilmazkuday (2020). Detailed analysis of cost increases across income groups enables policymakers to better understand price level dynamics and design effective interventions. Moreover, understanding consumption patterns helps monetary authorities manage challenges from currency depreciation, enhancing the effectiveness of monetary and exchange rate policies for greater economic stability.

Ethical Consideration:

Authors’ contributions

All authors have made substantial contributions to this study.

Funding

This study was not funded.

Conflicts of interest

The authors declared no conflict of interest.

Acknowledgments

In the present study, all ethical considerations, including the conditions of trust-

Worthiness, honesty, and non-plagiarism, were observed, also we would like to

Thank all those who contributed to this study

Asgharpour Hossein, Ali Mahdilou, (2014). The Impact of Inflationary Environment on Exchange Rate Pass- Through on Import Prices in Iran: Markov–Switching Approach. Quarterly Journal of Economic Research and Policies 22(70):75-102.[in Persian]. http://qjerp.ir/browse.php?a_id=758&sid=1&slc_lang=en

Heydari, Hassan and Rashidi, Mahsa, (2018). Estimating the impact of exchange rate changes on the producer price index in major sectors of Iran’s economy. Economic Modeling Research Quarterly 9(35):167-200.[in Persian]. http://jemr.khu.ac.ir/article-1-1663-en.html

Mehrabi Beshrabadi Hossein, Jalai. Seyyed Abdul Majeed, his effort. Mohammad Sajjad, (2010). Investigating the passing of exchange rates on the prices of imported and exported goods in Iran. Journal of humanities 6(12):101-123.[in Persian]. https://ensani.ir/fa/article/386953

Roshan, Isazadeh, (2014). Exchange rate pass-through, case study of Iran. Quarterly of strategic and wholesale policies 10(3):89-106.[in Persian]. https://sid.ir/paper/244321/fa

Introduction

In international economics, countries interact primarily through trade in goods/services and capital flows, making the exchange rate a critical element of economic relations. A deviation of the exchange rate from its equilibrium can destabilize economic performance. The exchange rate significantly influences macroeconomic variables—especially in today’s globalized economy where countries are highly interdependent. It serves as a key indicator of a country’s foreign trade position, affecting variables such as prices, production, and employment. With expanded global markets, domestic prices are increasingly affected by international exchange rate fluctuations. Open economies are now more exposed to external shocks, which often appear as exchange rate changes. The process through which these changes impact domestic price levels known as exchange rate pass-through is complex. Its extent is not only a channel for transmitting shocks but is also shaped by various micro and macroeconomic factors. At the micro level, elements such as the price elasticity of demand and the market power of firms play a role. At the macro level, factors like inflation, the output gap, exchange rate volatility, and the degree of economic openness are influential. These determinants can change with each shock, affecting the intensity and nature of pass-through. Consequently, the exchange rate’s impact—both on prices and quantities—is crucial for consumers in the short and long term, ultimately influencing their overall welfare.

Method

This study was conducted based on theoretical foundations and existing literature, as well as using econometric modeling. The econometric model used in this study is structural VAR (SVAR). In VAR models, the values of a variable are fitted to the values with its own interval.

In the current research, the time series data of 1363-1401(1984–2022) have been used annually, all the statistics and information of the time series and cross-sectional variables of the income groups used in the research (price of consumer goods, nominal exchange rate and amount of income) from the center Statistics of Iran The central bank has been collected, the general research model is as follows:

Z= [lnEX,lnY,LNP]

LnEX: is the log of the nominal exchange rate.

LnY: log of average income in income deciles

LNP log of the average price of consumer goods

In each income decile, before estimating the considered model, the series have been tested for reliability. Due to the annuality of the data used, all the data have been tested with a time interval. The effects of Exchange Rate Pass-Through on welfare have been analyzed through the analysis of a generalized equation as follows.

In this equation, the effect of Exchange Rate Pass-Through on price, income and finally on well-being has been evaluated.

Findings

The estimation of the exchange rate on the expenses of each income decile was examined separately. The results are shown in two urban and rural areas. These results are shown through the decrease in the average income in income deciles and the effect in increasing the average price level in urban and rural areas as a percentage. The greatest impact of the exchange rate Pass-Through was observed on the costs related to three health groups, education and communication costs. So that in almost all urban and rural income groups, this effect was about 0.7% and the highest level. Meanwhile, the higher urban income deciles have faced a higher effectiveness percentage in the health and education expenditure group.

The results of a 1% exchange rate shock (devaluation of the national currency, rial, against the dollar) lead to an approximate 0.72% reduction in welfare, with a range between 0.65% and 0.79% for income deciles in urban areas. This finding confirms the results of other studies on incomplete exchange rate pass-through, such as Mehrabi (2010) and Issazadeh Roshan (2014). For rural income deciles, this impact ranges between 0.71% and 0.75%. It is clearly observed that lower-income deciles in rural areas are significantly more exposed to exchange rate pass-through compared to urban areas. In the long term, the ninth and tenth income deciles in urban areas experience the greatest impact from exchange rate pass-through. These results are largely consistent with the findings of Yilmazkuday (2020) in Turkey, although the intensity of the exchange rate shock effect for higher-income deciles in Turkey is reported at about 0.81%, which shows a difference of approximately 0.02% to 0.09% .Regarding the type of expenditure, three categories of costs are more affected than others: communication expenses, education expenses, and health expenses, with this pattern being evident in both urban and rural areas. This highlights the need to pay particular attention to these three expenditure categories, especially for lower-income deciles.

Discussion

Exchange rate shocks significantly alter the cost and availability of basic consumer goods, prompting consumers and producers to adjust their consumption and production behaviors. To protect household welfare and mitigate the impact of currency fluctuations, it’s essential to examine how these changes affect various urban and rural income groups. Studies show that a 1% increase in the exchange rate leads to an incomplete pass-through effect on prices, as noted by heydari and rashidi (2018) and Asgharpour and Mahdilou (2014). However, import-dependent goods and services, such as medicine and healthcare, experience a more substantial impact, according to Yilmazkuday (2020). Detailed analysis of cost increases across income groups enables policymakers to better understand price level dynamics and design effective interventions. Moreover, understanding consumption patterns helps monetary authorities manage challenges from currency depreciation, enhancing the effectiveness of monetary and exchange rate policies for greater economic stability.

Ethical Consideration:

Authors’ contributions

All authors have made substantial contributions to this study.

Funding

This study was not funded.

Conflicts of interest

The authors declared no conflict of interest.

Acknowledgments

In the present study, all ethical considerations, including the conditions of trust-

Worthiness, honesty, and non-plagiarism, were observed, also we would like to

Thank all those who contributed to this study

Asgharpour Hossein, Ali Mahdilou, (2014). The Impact of Inflationary Environment on Exchange Rate Pass- Through on Import Prices in Iran: Markov–Switching Approach. Quarterly Journal of Economic Research and Policies 22(70):75-102.[in Persian]. http://qjerp.ir/browse.php?a_id=758&sid=1&slc_lang=en

Heydari, Hassan and Rashidi, Mahsa, (2018). Estimating the impact of exchange rate changes on the producer price index in major sectors of Iran’s economy. Economic Modeling Research Quarterly 9(35):167-200.[in Persian]. http://jemr.khu.ac.ir/article-1-1663-en.html

Mehrabi Beshrabadi Hossein, Jalai. Seyyed Abdul Majeed, his effort. Mohammad Sajjad, (2010). Investigating the passing of exchange rates on the prices of imported and exported goods in Iran. Journal of humanities 6(12):101-123.[in Persian]. https://ensani.ir/fa/article/386953

Roshan, Isazadeh, (2014). Exchange rate pass-through, case study of Iran. Quarterly of strategic and wholesale policies 10(3):89-106.[in Persian]. https://sid.ir/paper/244321/fa

Yilmazkuday, hakan, (2020)Unequal Exchange Rate Pass-Through across Income Groups. Macroeconomic Dynamics 25:1.44.: https://ssrn.com/abstract=3289652

Type of Study: orginal |

Received: 2024/03/3 | Accepted: 2024/11/20 | Published: 2025/07/6

Received: 2024/03/3 | Accepted: 2024/11/20 | Published: 2025/07/6

Send email to the article author

| Rights and permissions | |

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. |