Volume 22, Issue 87 (2-2023)

refahj 2023, 22(87): 105-148 |

Back to browse issues page

Download citation:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

sabermahani M, zeinaladeh R, Jalaee Sfandabadi S A, zayanderoody M. (2023). Investigating the Shocks of Real Sectors of the Economy on the Welfare Index in the Iranian Economy. refahj. 22(87), : 4 doi:10.32598/refahj.22.87.4008.1

URL: http://refahj.uswr.ac.ir/article-1-3977-en.html

URL: http://refahj.uswr.ac.ir/article-1-3977-en.html

Keywords: Amartya Sen ocial Welfare Index, Utilitarianism Social Welfare Index, Total Factor Productivity, Employment, Oil revenue

Full-Text [PDF 927 kb]

(2183 Downloads)

| Abstract (HTML) (3639 Views)

Full-Text: (2505 Views)

Introduction

Nowadays, one of the most appropriate criteria for measuring the economic situation of any country is to assess the social and welfare status, and improving the social welfare of each society as one of the macroeconomic goals should be considered by economic and social policymakers. Welfare indicates purchasing power and ability to acquire facilities and living facilities (Vafaei, Mohammadzadeh, Fallahi, & Asgharpour, 2017). Social welfare is also one of the basic needs of society and by properly recognizing the impact of macroeconomic factors on this index, economists and policymakers can adopt appropriate planning and policies. Among the variables that affect welfare, we can mention the variables of the real economic sector such as productivity, economic growth and oil revenues. Welfare is one of the main indicators of development and the purpose of development is not to produce more material goods or miscellaneous services, but the goal of development is to develop the capabilities and abilities of people so that human life is accumulated more creativity and satisfaction. Therefore, the use of single indicators such as GDP can not provide a comprehensive view of a country's welfare, and therefore the interest in the use of composite indicators has increased in recent decades (Sharpe, 1999).

One of the factors affecting the welfare is the shocks of the real economic sector. Because well-being is a concept that is used in all aspects of the social sciences, given its broad scope, people do not have a right grasp of the concept of well-being, and there is confusion about the meaning of well-being. The meaning of happiness, joy, health, success and prosperity is inferred from the word welfare, which dates back to the twentieth century (Greve, 2008). Van Praag (1953) introduced welfare as another expression of desirability. Pigou (1950) considers the elements and principles of welfare to be related to each other and considers money as the only way to measure it (Greve, 2008). Mc Gregor (2007) also believes that welfare is not a new concept in development studies and more generally in philosophy and social sciences, and many who discuss welfare refer to Aristotle's concept. In another view put forward by Panich (2007), wealth is not the goal of well-being but is essential to achieving social well-being.

Western Economic Diversification (2001) on the concept of well-being argues that well-being is related to improving the situation of others and social conditions, and well-being in how to communicate with others in the position of meeting the needs of the parties. Therefore, the welfare of individuals cannot be studied without considering the social contexts of society. Thus social welfare in the form of various forms including Bergson-Samuelson welfare function, Arrow social welfare function, individual social welfare function, Harsany Social Welfare Function, Atkinson social welfare function, Utilitarian Social Welfare Function, Rawlsian Social Welfare Function, Sen Social Welfare Function And the generalized Sen social welfare function is defined.

Among the variables that affect social welfare are economic growth, productivity, oil revenues and employment. The main question of this paper is how does the impulse of the real sectors of economy affect the welfare index? Accordingly, in this paper, the effect of real sector of the economy shocks on the social welfare in Iran during the period 1980-2019 has been investigated.

Metods

The research model according to the literature and theoretical foundations of previous studies such as ((Mahmoudi, 2019); (Abbasian, 2007); (Cristea, Georgiana Noja, Dănăcică, & Ştefea, 2020; Shahikitash, 2014) (Osberg & Sharpe, 2000) is specified as follows.

LWAMAR t = β 0 + i =1 T β t LWAMAR t - i + i =1 T α t LTFP t - i + i =1 T γ t LPGDP t - i + i =1 T θ t LOILR t - i + i =1 T π 541 t LLAB t - i + ε t

LWELFCE t = β 0 + i =1 T β t LWELFCE t - i + i =1 T α t LTFP t - i + i =1 T γ t LPGDP t - i + i =1 T θ t LOILR t - i + i =1 T π t LLAB t - i + ε t

In the present study, the welfare index is defined based on the utility welfare function (Samuelson, 1966). LWAMAR: Total consumption expenditure (fixed price in 2010) and LWAMAR: Amartya Sen Welfare Index is used as a welfare index proxy. LTFP: Total factor productivity growth. LPGDP: Real GDP per capita at constant price in 2010. LOILR: Oil revenues (in dollars). LLAB is the active population (as an employment proxy). L: natural logarithm and ε: residuals of the model. So that, the vector autoregression model (VAR) was used to estimate the model.

Findings

Figures (1 to 5) show the response of the WAMAR and the WELFCE to their own shocks.

As can be seen in Figures (1and2), the WAMAR and Amartya Sen welfare index had significant response to them shocks in the first period, which was adjusted over the time, So that It tends to be zero and stable.

Figure (3) shows the WAMAR response and Figure (4) shows the response of the WAMAR to the shocks of total factor productivity growth in Iran.

As indicated in Figure 3, the WAMAR response rapidly to shocks of total factor productivity growth in the first period, so over time, its effect reaches zero. Therefore, in the long run, the WAMAR index does not response to the shocks of total factor productivity growth. Also in Figure (4), the WELFCE shows a positive response to the shocks of total factor productivity growth in the first period, which has decreased and has become negative even from the fifth period. This means that in the long run, the WELFCE response negatively to shocks caused by total factor productivity.

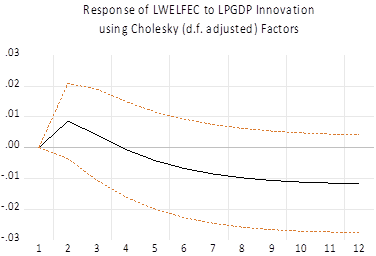

Figure (5) shows the response of the WAMAR and Figure (6) shows the response of the WELFCE to the shocks of real GDP per capita in Iran.

As shown in Figure (5), the WAMAR response positively to real GDP per capita shocks in the first period, which in the long run the WAMAR react negatively to real per capita GDP shocks. Also, in Figure (6), the WELFCE shows a positive and significant response to the real per capita GDP shocks in the first period. But its response is adjusted and decreases, even its response is negative. Thus, both WAMAR and WELFCE respond negatively to GDP shocks in the long run.

Figure (7) shows the reaction of WAMAR and Figure (8) shows the response of the WELFCE to the shocks of oil revenues in Iran.

As shown in figure 7, the WAMAR response to oil revenue and figure (8) shows that the WELFCE shows a positive response in the first period, but in the long run, its effect is partially positive. Therefore, in Iran, oil revenues have not been able to affect the welfare index.

Discution

The present study used the vector autoregression model (VAR) to investigate the effect of real sector of economy on the social welfare index in Iran during the period1980-2019. The results of the impulse response test showed that in the Iranian economy, employment lead to increased social welfare. But GDP per capita, oil revenue In the long run, oil revenue and total factor productivity have reduced social welfare. Therefore, in the Iranian economy, creating employment and reducing unemployment is the most appropriate factor to increase welfare.

Ethical Considerations

Funding

This study was extracted from a PHD thesis entitled “Investigating the Shocks of Real Sectors of the Economy on the Welfare Index in the Iranian Economy” which was conducted by Mina Sabermahani, supervised by Dr. Reza Zeinalzadeh, and approved by Faculty of PhD and Humanities at Islamic Azad University Kerman Beranch.

Authors’ contributions

All authors contributed in designing, running, and writing all parts of the research.

Conflicts of interest

The authors declared no conflict of interest

Acknowledgments

There is no ethical principle to be considered doing this research.

Nowadays, one of the most appropriate criteria for measuring the economic situation of any country is to assess the social and welfare status, and improving the social welfare of each society as one of the macroeconomic goals should be considered by economic and social policymakers. Welfare indicates purchasing power and ability to acquire facilities and living facilities (Vafaei, Mohammadzadeh, Fallahi, & Asgharpour, 2017). Social welfare is also one of the basic needs of society and by properly recognizing the impact of macroeconomic factors on this index, economists and policymakers can adopt appropriate planning and policies. Among the variables that affect welfare, we can mention the variables of the real economic sector such as productivity, economic growth and oil revenues. Welfare is one of the main indicators of development and the purpose of development is not to produce more material goods or miscellaneous services, but the goal of development is to develop the capabilities and abilities of people so that human life is accumulated more creativity and satisfaction. Therefore, the use of single indicators such as GDP can not provide a comprehensive view of a country's welfare, and therefore the interest in the use of composite indicators has increased in recent decades (Sharpe, 1999).

One of the factors affecting the welfare is the shocks of the real economic sector. Because well-being is a concept that is used in all aspects of the social sciences, given its broad scope, people do not have a right grasp of the concept of well-being, and there is confusion about the meaning of well-being. The meaning of happiness, joy, health, success and prosperity is inferred from the word welfare, which dates back to the twentieth century (Greve, 2008). Van Praag (1953) introduced welfare as another expression of desirability. Pigou (1950) considers the elements and principles of welfare to be related to each other and considers money as the only way to measure it (Greve, 2008). Mc Gregor (2007) also believes that welfare is not a new concept in development studies and more generally in philosophy and social sciences, and many who discuss welfare refer to Aristotle's concept. In another view put forward by Panich (2007), wealth is not the goal of well-being but is essential to achieving social well-being.

Western Economic Diversification (2001) on the concept of well-being argues that well-being is related to improving the situation of others and social conditions, and well-being in how to communicate with others in the position of meeting the needs of the parties. Therefore, the welfare of individuals cannot be studied without considering the social contexts of society. Thus social welfare in the form of various forms including Bergson-Samuelson welfare function, Arrow social welfare function, individual social welfare function, Harsany Social Welfare Function, Atkinson social welfare function, Utilitarian Social Welfare Function, Rawlsian Social Welfare Function, Sen Social Welfare Function And the generalized Sen social welfare function is defined.

Among the variables that affect social welfare are economic growth, productivity, oil revenues and employment. The main question of this paper is how does the impulse of the real sectors of economy affect the welfare index? Accordingly, in this paper, the effect of real sector of the economy shocks on the social welfare in Iran during the period 1980-2019 has been investigated.

Metods

The research model according to the literature and theoretical foundations of previous studies such as ((Mahmoudi, 2019); (Abbasian, 2007); (Cristea, Georgiana Noja, Dănăcică, & Ştefea, 2020; Shahikitash, 2014) (Osberg & Sharpe, 2000) is specified as follows.

In the present study, the welfare index is defined based on the utility welfare function (Samuelson, 1966). LWAMAR: Total consumption expenditure (fixed price in 2010) and LWAMAR: Amartya Sen Welfare Index is used as a welfare index proxy. LTFP: Total factor productivity growth. LPGDP: Real GDP per capita at constant price in 2010. LOILR: Oil revenues (in dollars). LLAB is the active population (as an employment proxy). L: natural logarithm and ε: residuals of the model. So that, the vector autoregression model (VAR) was used to estimate the model.

Findings

Figures (1 to 5) show the response of the WAMAR and the WELFCE to their own shocks.

|

|

| Figure (1) Response of WAMAR to impulse itself | Figure (2) Response of WELFCE to impulse itself |

Figure (3) shows the WAMAR response and Figure (4) shows the response of the WAMAR to the shocks of total factor productivity growth in Iran.

|

|

| Figure (3) Response of WAMAR to TFP shocks | Figure (4) Response of WELFCE to TFP shocks |

Figure (5) shows the response of the WAMAR and Figure (6) shows the response of the WELFCE to the shocks of real GDP per capita in Iran.

|

|

| Figure (5) Response of WAMAR to Per Capita GDP shocks | Figure (6) Response of WELFCE to Per Capita GDP shocks |

Figure (7) shows the reaction of WAMAR and Figure (8) shows the response of the WELFCE to the shocks of oil revenues in Iran.

|

|

| Figure (7) Response of WAMAR to oil revenue shocks | Figure (8) Response of WELFCE to oil revenue shocks |

Discution

The present study used the vector autoregression model (VAR) to investigate the effect of real sector of economy on the social welfare index in Iran during the period1980-2019. The results of the impulse response test showed that in the Iranian economy, employment lead to increased social welfare. But GDP per capita, oil revenue In the long run, oil revenue and total factor productivity have reduced social welfare. Therefore, in the Iranian economy, creating employment and reducing unemployment is the most appropriate factor to increase welfare.

Ethical Considerations

Funding

This study was extracted from a PHD thesis entitled “Investigating the Shocks of Real Sectors of the Economy on the Welfare Index in the Iranian Economy” which was conducted by Mina Sabermahani, supervised by Dr. Reza Zeinalzadeh, and approved by Faculty of PhD and Humanities at Islamic Azad University Kerman Beranch.

Authors’ contributions

All authors contributed in designing, running, and writing all parts of the research.

Conflicts of interest

The authors declared no conflict of interest

Acknowledgments

There is no ethical principle to be considered doing this research.

Type of Study: orginal |

Received: 2021/10/11 | Accepted: 2022/07/20 | Published: 2023/02/8

Received: 2021/10/11 | Accepted: 2022/07/20 | Published: 2023/02/8

Send email to the article author

| Rights and permissions | |

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. |